The following important article was authored by Dr. Peter Varadi, a colleague, friend, and a true solar energy pioneer. It was published today (10 July 2015) in the e-journal energypost.eu, and is republished here with the author’s permission. An introduction was added by Karel Beckman, editor-in-chief of energy post.eu.

Solar Revolution Meets Wall Street

July 10, 2015 by Peter F Varadi

Introduction: The invention of the YieldCo is a gamechanger that will enable spectacular growth of solar PV, writes solar pioneer Peter F. Varadi. According to Varadi, the PV YieldCo offers significant advantages over investments in fossil fuel power: no fuel supply is needed, no long-term purchasing contracts for the generated electricity and less costly infrastructure. The solar revolution meets Wall Street.

Solar power in the US is still lagging behind China and Germany, but if solar pioneer Peter F. Varadi is right, America may well catch up pretty soon. The reason is the YieldCo. A typically American financial innovation that will act as a “solar breeder”, argues Varadi.

The YieldCo is essentially an independent power producing (IPP) corporation that operates renewable energy assets, such as wind, solar and hdyro. The company is publicly traded, “yields” a predictable cash flow, and distributes its income to its shareholders. Thus, it opens up the renewable energy (especially solar PV) sector to investment by small mutual funds and millions of private citizens. The far-reaching effects will become apparent over the next few years, says Varadi: the YieldCo will transform the US solar market.

………………………………..

In 1982 at Solarex, a company I co-founded in 1973 which had by then become the largest PV producer in the world, we envisioned a “Solar Breeder”. The idea was that we would manufacture solar cells and modules which would be mounted on the roof of our production facility to produce electricity which would then be used to produce solar cells and modules, etcetera.

With the completion of Solarex’s new solar cell and module manufacturing facility in 1982, the realization of this idea was started.

The slanted roof of the Solarex building (see photo) was covered with a PV roof producing 200 kW of electricity. The produced DC electricity was stored in batteries and converted to AC. The system was used to power 24/7 the production control systems.

The World’s first and at that time the largest (200 MW) rooftop PV system. Courtesy of Mr. Ramon Dominguez

The cost of PV modules in those days was quite high, but we were able to do this, because that was the time when we developed the multicrystalline wafer casting technique. We did not want to sell the early production before we had experience with PV modules produced from those wafers to ensure that the process worked well. So, the first 200 kW of modules were mounted on the roof of the facility.

The idea of the “solar breeder” was tested, but in those days to power the entire production of a solar cell and module production facility would have been prohibitively expensive. The idea went dormant.

The reincarnation of the “Solar Breeder” idea with an economic twist came about 30 years later. The Solarex idea was to produce solar cells and modules by utilizing the electricity generated by a PV system. The new “Solar Breeder” idea is to utilize the income generated by selling PV systems to finance the production of more solar cells and modules to build the next PV systems. The new “Solar Breeder” concept is called “YieldCo”. It is transforming the solar power sector.

The invention of the “YieldCo” system

The origin of the “YieldCo” idea in the USA goes back to 1960 when President Dwight D. Eisenhower signed the Real Estate Investment Trust (REIT) law. REITs are corporations which own and operate real estate properties and distribute their income to the shareholders. The REIT idea became so popular that at present REITs exist in 37 countries and in 2014 were listed globally on 456 stock exchanges.

21 years later the idea was extended to Master Limited Partnerships (MLP) pertaining first to “natural resources” such as petroleum and natural gas extraction and transportation. The first MLP was Apache Petroleum Company in 1981, based on oil and gas resources. The idea became so popular that it was adapted to a variety of industries.

In 2012, 52 years after the REIT financial program was started the “YieldCo” idea was initiated. YieldCo is basically the adaptation of the REIT program to Renewable Energy (RE), by forming an independent power producing (IPP) corporation to operate primarily RE (water, wind and solar) assets. The company is publicly traded, “yields” a predictable cash flow, and distributes its income to the shareholders.

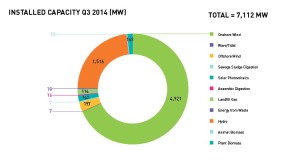

The first YieldCo in the renewable energy field was Brookfield Asset Management’s subsidiary Brookfield Renewable Energy Partners. It was established – only 3 years ago – at the beginning of 2012 and is listed on the New York stock exchange (BEP). BEP’s assets are hydroelectric (80%) and wind plants (20%) scattered all over the world with a total installed capacity of about 7,000 MW.

The basis of the success of the YieldCos is manifold:

Because they are on the stock market the possibility of relatively small investment by mutual funds and small investment by private citizens opens the pocket book of millions.

Liquidity: one can get money out when needed.

Relatively stable cash flow: for example the electric yield of PV systems is predictable for at least 20 years and is not affected by political or financial crises which puts YieldCos, in terms of risk limitation, ahead of REITs or MLPs.

Result of the success of the first “YieldCo”

The stock market success of Brookfield opened up the floodgates to other RE YieldCos:

2013

April: Hannon Armstrong Sustainable Yield Infrastructure Capital Inc. (HASI) New York stock exchange (NYSE). [Financing energy efficiency projects also wind and solar]

July: NRG Yield Inc. (NYLD) New York stock exchange (NYSE) – [Wind, Natural gas, PV (12%)]

July: TransAlta Renewables (RNW) Toronto stock exchange. [wind 63% – Gas 31% and Hydro 6%]

September: Pattern Energy Group (PEGI) New York stock exchange (NASDAQ-NMS) – [Wind]

2014

June: Abengoa Yield (ABY) New York stock exchange (NASDAQ-NMS) – [50% concentrated solar thermal (not PV), 3% water, conventional power and Electric transmission].

June: NextEra Energy Partners (NEP) New York stock exchange (NYSE) – [77% Wind, and 23% PV]

July: TerraForm Power (TERP) New York stock exchange (NASDAQ-NMS) [Started with 100% PV, added recently some wind]. TerraForm Power was created by SunEdison, one of the biggest PV manufacturers in the USA.

2015

June 19th: 8point3 (CAFD) New York stock exchange (NASDAQ-NMS) First Solar and SunPower the other large PV manufacturers in the USA created a joint YieldCo by transferring to it PV systems.

2015 (planned)

TerraForm Global Inc.: SunEdison after its successful first experience filed an S-1 form with the U.S. Securities andExchange Commission (SEC) for this initial public offering to raise US $700 million.

NSP: Neo Solar Power Corporation at the moment the largest Taiwanese Solar cell and module manufacturer announced that it plans to announce Taiwan’s first YieldCo to be listed on the Hong Kong Stock exchange by the end of 2015.

YieldCos’ solar assets

As part of a YieldCo asset mixture the utilization of PV started in 2013 (e.g. NRG Yield Inc. – 12%).

In 2014 “Abengoa Yield” (ABY), a subsidiary of Abengoa S.A., a Spanish company, was the first YieldCo that had concentrated solar (thermal) systems (CSP not PV) as the majority of its asset mixture. Abengoa produces large scale CSP systems such as “Solana” (280 MW) located 70 miles southwest of Phoenix, AZ, and obviously had faith that their operation will be satisfactory. “Abengoa Yield” was created by assembling several CSP Assets in Spain and in South Africa and raised US $828 million.

But the most remarkable YieldCo in 2014 was SunEdison’s because it was the first PV manufacturing company which created a YieldCo [TerraForm Power (TERP)] consisting entirely of PV systems (utility scale PV 848 MW and distributed PV 283 MW). In 2015 SunEdison is planning to establish its second YieldCo (TerraForm Global Inc.). SunEdison was the first PV manufacturer to reincarnate the “Solar Breeder” ide a. SunEdison manufactured PV systems, transferred them to a newly created YieldCo and received cash which it can use to produce new PV systems.

Following SunEdison two major US manufacturers, First Solar and SunPower, formed a joint YieldCo, 8point3, the assets of which are 100% PV and which went public on June 19, 2015. This is also a good example of the Solar Breeder system: they manufactured PV systems, transferred them to a newly created YieldCo, and received US $420 million cash which they can use to produce new PV systems. The strange name, 8point3, derives from the fact that it takes 8.3 minutes for the sun’s radiation to reach the earth.

Thus, in 2014/2015 all of the three major US PV manufacturers established their first YieldCo.

The announcement by Neo Solar Power Corporation (NSP) of Taiwan that it is planning to establish a YieldCo in 2015 indicates that the YieldCo idea has spread to the Asian PV manufacturers. It is now only a matter of time before the many Chinese, Korean and Indian PV manufacturers will see the light and establish YieldCos as well. The money to be raised for PV systems b y this approach will dwarf Warren Buffett’s US $2.5 billion which his company invested in the Antelope Valley Solar Projects in California.

Why PV assets will be preferred in YieldCos

As we saw, at the outset the assets of YieldCos were primarily hydro and wind systems. Now they are turning more and more to PV. The three US PV manufacturers started their YieldCo’s with 100% PV assets. There are two main reasons why PV in future will dominate the assets assembled to create YieldCos.

Location: In order to establish a RE YieldCo one needs to build or acquire RE electric power generating system(s). These systems could be hydro, wind, concentrating solar and solar PV. Of these systems hydro, wind and concentrating solar can only be established where there is water, sufficient wind or direct, unscattered sunshine available. These are only available in a limited number of places on earth. PV systems on the other hand can be established in most parts of the Earth where people live. An example is Germany which is not the sunniest part of our planet. It is located quite far north and it has lots of cloudy days but at this time there is more PV capacity installed in Germany than in any other country. This means, that YieldCos utilizing PV assets could be anywhere. The other RE assets are more limited and soon only a limited number will be available for YieldCo.

ROFO: For tax reasons YieldCos have to invest constantly in new assets to assure the growth of income for distribution to shareholders. It is therefore extremely important that the YieldCo has a contract with the technology “sponsor” (originator) to be able to obtain assets that the “sponsor” is developing. This ensures a pipeline for future assets and a “right to first offer” (ROFO) for the assets. This strange wording is a remnant of REIT, the ancestor of YieldCo, and means “Right of First Negotiation”, so that the “sponsor” should have good faith negotiations with the YieldCo before negotiating with other parties. The idea behind this is that the YieldCo should have an assured path to new assets. To assure a pipeline in hydro or wind is complicated as they have to be found at a proper location and may not be always available. However, if a PV manufacturer is the “sponsor” it can assure the continuation of new PV assets in any size and location at any time when needed, because the PV manufacturer’s business is to produce them continuously. PV applications are ubiquitous and can be installed quickly.

The advantage of the YieldCo system for PV manufacturers

PV YieldCo is the perfect solar breeder. A YieldCo’s shares when sold can be used as a source of low cost money for producing more PV systems. The beauty for the manufacturer is, that by establishing a YieldCo based on the PV manufacturer’s need of cash it can sell

all the shares or

as many shares for as much money as the PV manufacturer needs, and enjoy the income from the unsold shares and

may retain management and maintenance contracts, which provides additional income.

PV manufacturers for a long time will not have to face overcapacity and unsold inventory, because it can be used to produce YieldCos.

PV manufacturers do not have to find single investors like Warren Buffett’s company which can afford to invest lots of money to buy a large utility size PV system. People can buy the YieldCo shares in any quantity and it has been shown that it was not a problem for PV YieldCos to generate many hundreds of millions of dollars of investment capital.

Finally, a PV YieldCo offers significant advantages over an investment in a fossil fuel power generating system. Fossil fuel power plant needs three things to be economically successful: a long term agreement for fuel supply at reasonable cost; capital investment to build the plant; and a long term guaranteed customer base.

For a PV YieldCo these issues are vastly simplified: one does not have to secure a long term contract for the fuel, because the nuclear reactor in the sun provides it free of charge; raising money on the stock market for a YieldCo turns out to be much easier than convincing lenders to provide the large amount of money to build a fossil fuel plant; and there is no need to look for customers who would sign a long term contract, as PV systems can be built anywhere and can reach customers easily: through the utilities by the existing grid or by a mini-grid; or directly when they are off-grid.

YieldCos’ influence on the future

For all these reasons, I have come to the conclusion that the effect of global implementation of the PV YieldCo system will radically increase the growth of the utilization of PV and accelerate the expansion of PV companies. More than that: it will also affect the solar PV distribution system, influencing other industries at the same time, for example reshaping the business model of utilities. Financial revolutions can be no less important than technological revolutions.

© Peter F. Varadi. All rights reserved

Peter F. Varadi wrote a history of the early years of the solar industry, Sun Above the Horizon, published last year by Pan Stanford Publishing, and reviewed here on Energy Post.