The following piece was first published on energypost.eu and the text is reprinted here as a new blog post.

……………………..

US desperately needs a national energy policy

September 24, 2015 by Allan Hoffman

The US – and indeed the world – is at a crossroads when it comes to the choice on how we want to provide energy services in the future, writes US energy expert Allan Hoffman. According to Hoffman, the US desperately needs a national energy policy that recognizes the importance of moving to a renewable energy future as quickly as possible. Without such a policy, economic growth, the environment and national security will suffer.

There are two fundamental ‘things’ needed to sustain human life, water and energy. Water is the more precious of the two as reflected in the Arab saying “Water is life.” Without water life as we know it would not exist, and there are no substitutes for water – without it we die.

We also need energy to power our bodies, derived from chemical conversions of the food we consume. We also need energy to enable the external energy services we rely on in daily life – lighting, heating, cooling, transportation, clean water, communications, entertainment, and commercial and industrial activities. Where energy differs from water as a critical element of sustainable development is the fact that energy is available in many different forms for human use – e.g., by combustion of fossil fuels, nuclear power, and various forms of renewable energy.

Critical juncture

Today the U.S., and indeed the world, stands at a critical juncture on how to provide these energy services in the future. Historically, energy has been provided to some extent by human power, by animal power, and the burning of wood to create heat and light. Wind energy was also used for several centuries to power ships and land-based windmills that provided mechanical energy for water-pumping and threshing. With the discovery and development of large energy resources in the form of stored chemical energy in hydrocarbons such as coal, petroleum, and natural gas, the world turned to the combustion of these fuels to release large amounts of thermal energy and eventually electricity with the development of steam power generators. Nuclear power was introduced in the period following World War II as a new source of heat for producing steam and powering electricity generators and ships.

My recommendation is to put a long-term and steadily increasing price on carbon emissions to motivate appropriate private sector decisions to use fewer fossil fuels and more renewable energy and let the markets work

Renewable energy, energy that is derived directly or indirectly from the sun’s energy intercepted by the earth (except for geothermal energy that is derived from radioactive decay in the earth’s core), has been available for a while in the form of hydropower, originally in the form of run-of-the-river water wheels, and since the 20th century in the form of large hydroelectric dams. Other forms of renewable energy have emerged recently as important options for the future, driven by steadily reducing costs, the realization that fossil fuels, while currently available in large quantity but eventually depletable, put carbon dioxide into the atmosphere when combusted, contributing to global warming and associated climate change. Renewable energy technologies, except for biomass conversion or combustion, puts no carbon into the atmosphere, but even in the biomass case it is a no-net-carbon situation since carbon is absorbed in the growing of biomass materials such as wood and other crops.

Support for renewables is also driven by increasing awareness that while nuclear power generation does not put carbon into the atmosphere it does create multigenerational radioactive waste disposal problems, can be expensive, raises low probability but high consequence safety issues, and is a step on the road to proliferation of nuclear weapons capability. Another driver is the now well documented and growing understanding that renewable energy, in its many forms, can provide the bulk of our electrical energy needs, as long disputed by competing energy sources.

Clean future

All these introductory comments are leading to a discussion of the energy policy choice facing our country, and other countries, and my recommendations for that policy. This choice has been avoided by the U.S. Congress in recent years, much to the short-term and long-term detriment of the U.S. We desperately need a national energy policy that recognizes the importance of energy efficiency and moving to a renewable energy future as quickly as possible. That policy should be one that creates the needed environment for investment in renewable technologies and one that will allow the U.S. to be a major economic player in the world’s inevitable march to a clean energy future.

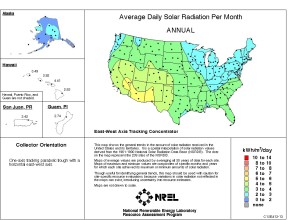

Before getting into policy specifics, let me add just a few more words on renewable energy technologies. Hydropower is well known as the conversion of the kinetic energy of moving water into electrical energy via turbine generators. Solar energy is the direct conversion of solar radiation directly into electricity via photovoltaic (solar) cells or the use of focused/concentrated solar energy to produce heat and then steam and electricity. Wind energy, an indirect form of solar energy due to uneven heating of the earth’s surface, converts the kinetic energy of the wind into mechanical energy and electricity. Geothermal energy uses the heat of the earth to heat water into steam and electricity, or to heat homes and other spaces directly. Biomass energy uses the chemical energy captured in growing organic material either directly via combustion or in conversion to other fuel sources such as biofuels. Ocean energy uses the kinetic energy in waves and ocean currents, and the thermal energy in heated ocean areas, to create other sources of mechanical and electrical energy. All in all, a rich menu of energy options that we are finally exploring in depth.

Controversial

Energy policy is a complicated and controversial field, reflecting many different national, global, and vested interests. Today’s world is largely powered by fossil fuels and is likely to be so powered for several decades into the future until renewable energy is brought more fully into the mainstream. Unnfortunately this takes time as history teaches, and the needs of developing and developed nations (e.g., in transportation) need to be addressed during the period in which the transition takes place.

The critical need is to move through this transition as quickly as possible. Without clear national energy policies that recognize the need to move away from a fossil fuel-based energy system, and to a low-carbon clean energy future, as quickly as possible, this inevitable transition will be stretched out unnecessarily, with adverse environmental, job-creation, and other economic and national security impacts.

My recommendation is to put a long-term and steadily increasing price on carbon emissions to motivate appropriate private sector decisions to use fewer fossil fuels and more renewable energy and let the markets work. Nuclear power, another low-carbon technology, remains an option as long as the problems listed earlier can be addressed adequately. My personal view is that renewables are a much better answer.

The revenues generated by such a ‘tax’ can be used to reduce social inequities introduced by such a tax, lower other taxes, and enable investments consistent with long-term national needs. In the U.S. it also provides a means for cooperation between Republicans and Democrats, something we have not seen for several decades. It is clear that President Obama ‘gets it’. It is now more than time for U.S. legislators to get it as well.

Editor’s Note (Karel Beckman, energypost.eu)

Allan Hoffman, former Senior Analyst in the Office of Energy Efficiency and Renewable Energy at the U.S. Department of Energy (DOE), writes a regular blog: Thoughts of a Lapsed Physicist.

On Energy Post, we regularly publish posts from Allan’s blog,in his blog section Policy & Technology. His writings often deal with issues at the intersection of energy technology, policy and markets. Allan, who holds a Ph.D. in physics from Brown University, served as Staff Scientist with the U.S. Senate Committee on Commerce, Science, and Transportation, and in a variety of senior management positions at the U.S. National Academies of Sciences and the DOE. He is a Fellow of the American Physical Society and the American Association for the Advancement of Science.